How to Work in the U.S. As a Foreign-Educated Accountant (CPA)

Accounting jobs are on the rise in the United States, and many individuals find this profession both challenging and fulfilling. Those living outside of the U.S. might be wondering how to become a foreign-educated accountant due to the many benefits that this job provides. According to the U.S. Bureau of Labor Statistics, accountants make between $47,970 and $128,970, with the average annual salary being $77,250.

If you want to pursue these benefits, consult our guide on becoming a foreign-educated accountant (also called a Certified Public Accountant or CPA) in the U.S. We answer vital questions such as:

- What Is the Process for Working in the U.S. As a Foreign-Educated Accountant?

- How Much Does It Cost to Work as a Foreign-Educated Accountant in the U.S.?

- How Long Does It Take to Work as a Foreign-Educated Accountant in the U.S.?

- Are There Any Restrictions to Working as a Foreign-Educated Accountant in the U.S.?

- What Are the State-Specific Requirements for Foreign-Educated Accountants?

- What Are the Immigration Requirements for Foreign-Educated Accountants?

- Where Can I Get a Certified Translation?

What Is the Process for Working in the U.S. As a Foreign-Educated Accountant?

There are several steps associated with the process of working in the United States as a foreign-educated accountant, they include:

- Select the state where you wish to practice as an accountant. It’s important to know this information ahead of time, as each state’s requirements vary regarding what you need in order to obtain full licensure and whether you will be required to complete continuing education credits to maintain or renew your license.

- If needed, work to improve your English language skills. You will be expected to work in English in the United States and all exams, studying materials, applications, and licensure information will be administered in English.

- Gather all pertinent documents, including academic transcripts showing completion of at least 150 credit hours, resumes and job information about CPA work completed in your home country, and degrees, licenses, or certifications.

- Obtain a credential evaluation of any of the academic work you’ve completed. A credential evaluation is a key step, as you must meet the education requirement of 150 credit hours of accounting education before you are eligible to take the CPA Exam.

The Board of Accounting in the state you wish to work in will provide you with specific information about which credential evaluation service to use, but most states require you to obtain an evaluation through the National Association of State Boards of Accounting (NASBA). Some states will only accept evaluations completed through this organization, so make sure to check with your preferred state before completing this step.

- Begin studying for the CPA Exam. The CPA Exam has four sections, and all states require you to obtain a passing score on each section before you are eligible to apply for licensure in the state. Studying for the CPA Exam may take a while due to its more rigorous nature, so make sure you understand the exam and what might be required of you when it comes to a studying timeline. In general, it’s recommended that you take a year to study and successfully pass this exam, with 3 months dedicated to each section.

- Once you’ve received your credential evaluation report (this can take between 6 and 8 weeks to receive) and you feel prepared to start taking the CPA exam, you will need to apply for your Notice to Schedule (NTS). The NTS is a document that verifies you are qualified to take the CPA exam and eligible to schedule a testing date. Most states require you to apply for the NTS through NASBA’s CPA Central online portal, but you will need to double-check the exact requirements of the state you wish to work in.

There is a fee associated with the NTS application, and international applicants may need to pay an additional fee on top of the basic application fee. You can expect to receive your NTS within 6 to 8 weeks after a first-time application, or within 2 weeks if you are submitting a repeat application. - After you have received your NTS, you can start scheduling test dates for the CPA Exam. This is typically done through Prometric, the organization that administers the Uniform CPA Exam.

Again, you will need to double-check with specific state requirements to ensure you are following the most accurate test scheduling process. It’s also important to note that you cannot take the same section of the exam twice in the same testing window; this means that if you fail one specific section, you can only test the other three sections until the next trimester, where you can try again at the test sections you failed. The Association of International Certified Professional Accountants (AICPA) provides more detailed testing information.

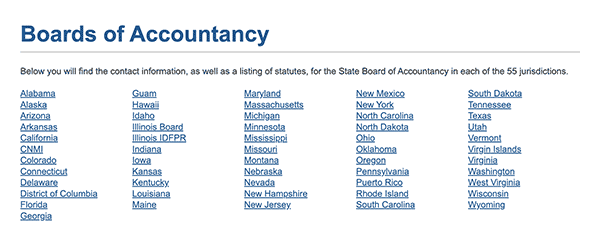

- When you have successfully passed each of the four sections of the CPA Exam (this must be completed within 18 months of your first test attempt), you can start the process of applying for state licensure. State licensure requirements vary based on the state you are applying to practice in, but most states have an experience requirement of between 1 and 2 years of accounting work completed. Most states will also require your credential evaluation information to be submitted as part of your applications, and there will be fees associated with your CPA licensure application. Select your preferred state’s Board of Accountancy using the directory on NASBA’s website.

- Around the same time that you are applying for CPA licensure in the United States, you should also be researching the visa process. If you intend to move to the United States to practice as a CPA, then you will need a visa to legally immigrate. The visa type required of most accountants will be the H-1B visa for specialty occupations. You will need to submit an application for this with the U.S. Department of State, and you will most likely need a U.S.-based employer to sponsor you.

After completing all of these steps, obtaining your state CPA licensure, and obtaining an employment visa for the United States, you can then move to your preferred state and begin practicing as a U.S. CPA.

Make sure when proceeding through these steps that you obtain all necessary certified translations and double-check any forms or applications. Doing so minimizes the chances of visa applications, exam results, and job applications being rejected or delayed due to avoidable errors.

Certification of Translation Accuracy Sample

Order Your Certified Translation

How Much Does It Cost to Work as a Foreign-Educated Accountant in the U.S.?

The process is not inexpensive; however, many individuals treat it as an investment. After all, this process is necessary if you want to immigrate to the United States and legally practice your profession.

The CPA Exam typically costs around $4,000, including study materials that you might need to purchase, test registration fees and applying for your NTS.

Additionally, foreign-education accountants will need to obtain a credential evaluation of their academic qualifications and proof of employment history. This typically costs between $100 and $300.

Visa applications for the H-1B visa cost around $460, not including any other fees that might be more situation specific. You might also need to pay state licensing fees and fees for obtaining certified translations of your foreign credentials.

Overall, you can expect to pay around $4,860 – $5,000 on average to work as a foreign-educated accountant in the United States.

How Long Does It Take To Work as a Foreign-Educated Accountant in the U.S.?

You will need at least a year to study for the CPA exam, and you may need up to 18 months to successfully pass each section. H-1B visas also have varying processing times, and you may receive this anywhere between 2 and 13 months after your application is submitted.

This means that it can take you between 2 and 3 years on average to become a foreign-educated accountant working in the U.S.

Are There Any Restrictions to Working as a Foreign-Educated Accountant in the U.S.?

Once you have passed the CPA exam, obtained your state license, and entered the United States on the correct visa, there are no restrictions to working in the U.S. Make sure that you double-check state requirements to keep up with any continuing education requirements and ongoing licensing renewals so that you can legally practice as an accountant in your state on an uninterrupted basis.

What Are the State-Specific Requirements for Foreign-Educated Accountants?

The state-specific requirements for foreign-educated accountants tend to include varying lengths of work history, certain academic achievements (such as a Master’s degree in accounting), certain application processes, required ethics exams, and fees for state licensure. Some states also have continuing education requirements for accountants that you will need to complete yearly.

It’s important to verify this information with the state board of accounting of the state you wish to work in, as this will give you a better idea of what it takes to become licensed and practice as an accountant in that specific state.

What Are the Immigration Requirements for Foreign-Educated Accountants?

Foreign-educated accountants (CPAs) that wish to immigrate to the United States and practice their profession will be required to obtain a visa to complete this process. The visa type that the majority of accountants will need to apply for is the H-1B visa for specialty occupations. In most cases, you will need a U.S.-based employer to sponsor you as part of this visa application.

More detailed information on the H-1B visa is found on the United States Citizenship and Immigration Services website.

Where Can I Get a Certified Translation?

Certified translations are essential to obtain as you request credential evaluations, apply for your state license, complete your visa application, and apply for jobs, as most organizations, government agencies, and companies will request your original academic transcripts, diplomas, licenses and certifications, and job history from your home country along with a certified translation of the document into English.

You can obtain a certified translation of important documents like the ones below by visiting our online store.

We translate:

- Diplomas

- Academic transcripts

- Licenses and certifications

- Resumes and employment records

- Birth certificates

Guaranteed Acceptance

All our certified to English translations are accepted by the USCIS. Our translations follow the guidelines established by the USCIS and are also accepted by educational institutions.

Most Requested Documents

FAQs

You can order most translations 24 hours a day, 7 days a week through our online store. For large projects (more than 20,000 words or 50 pages), please request a quote.